Augmented Reality implementation in the banking industry has the potential to enhance customer interaction with financial institutions and transform banking into a more engaging, efficient, and convenient experience.

HomeCategory

Blog | NF Innova

Top 100 Fintech and Neo-bank business organizations are now valued 38% of the value of top 100 Banks VS 3% in 2010 according to „The Fintech Job Report 2021“, published by Center for Finance, Technology and Entrepreneurship

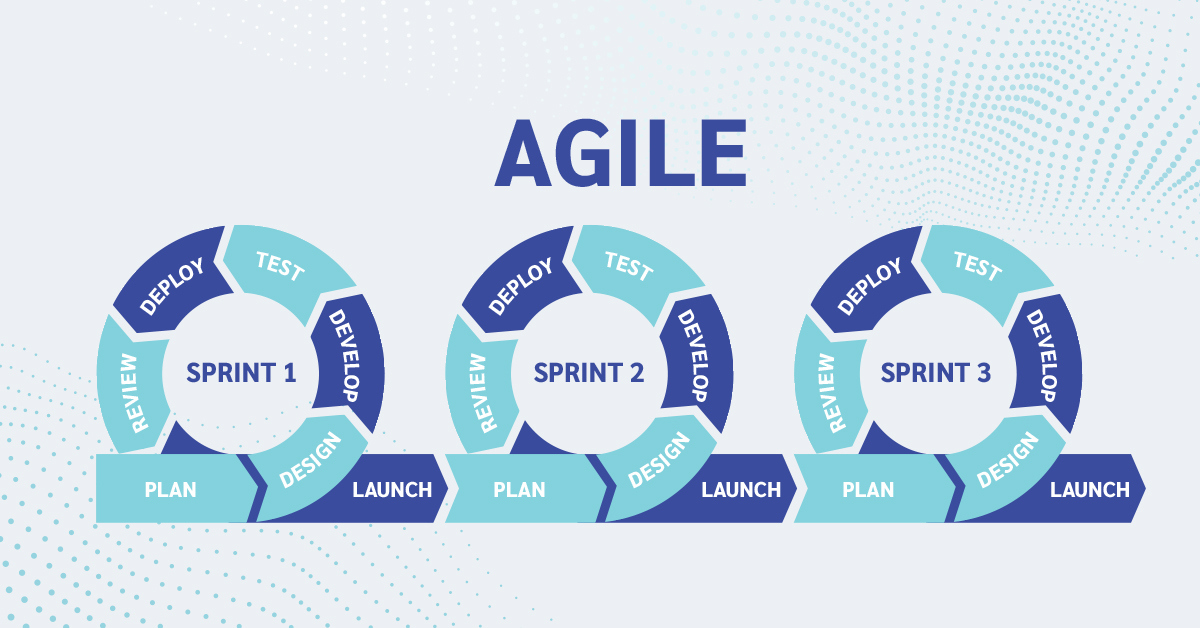

With Agile, banks get the opportunity to actively participate in the development of services, as well as to monitor their development and implementation. Deliveries are significantly shorter and the quality of delivery is better.

How can segmentation increase the revenue, number of users and their satisfaction? Are banks using the precious data they possess in the right way?

Neo banks operate only in the digital world. They design their digital business model and information system and then develop only one application that covers all processes from front end to digital operational processes for financial services. Operation is automated ̶ software driven and designed for digital world.