Online Onboarding

Fast and easy registration

New customers who decide to use the bank’s services can open their accounts in just a few minutes. The End-to-End automated digital processes enable immediate fulfillment of customers’ requests, such as a real-time account opening. This process is a part of the optichannel customer enrolment process, which gives users an option to start their registration on the web and finish on mobile or any other device of their choice. When they begin the procedure, they should follow a few steps, including ID scan & Face recognition, to successfully finish the sign-up without going to a bank.

Implementation of this solution includes several suitable options: digital signature, document storage, simple integration, and orchestration of external systems (Credit Bureau, Database of Home Affairs, etc.) The entire process is backed up with the KYC (Know-Your-Client) and AML (Anti-Money Laundering) policies. This allows banks to meet their obligatory regulations regarding the data entirely.

Online Loans

From a request to payment in a few minutes

Nowadays, customers who are buying goods online also expect to purchase banking products, as simple and as fast. To meet their expectations, we introduced a new, fully automated digital solution for bank customers. Keeping in mind today’s necessity for social distancing and minimized contact in branches, we launched an online loan solution that is easy, quick, and convenient. This way, we reduced the overall process length and enabled customers to request loans in just a few minutes.

Online Know-Your-Customer Process

Innovative way to open an account

Online onboarding offers convenience for busy customers who want to open an account in your bank. So we kept the customer identification part of that process easy and straightforward. This way, banks get a simplified online customer acquisition and save time for both–themselves and their clients.

Two approaches to online KYC are typically used: video call identification and/or automated face matching. The former one consists of the video call with the Bank’s agent, who will perform customer identification during the call and allow the customer to onboard.

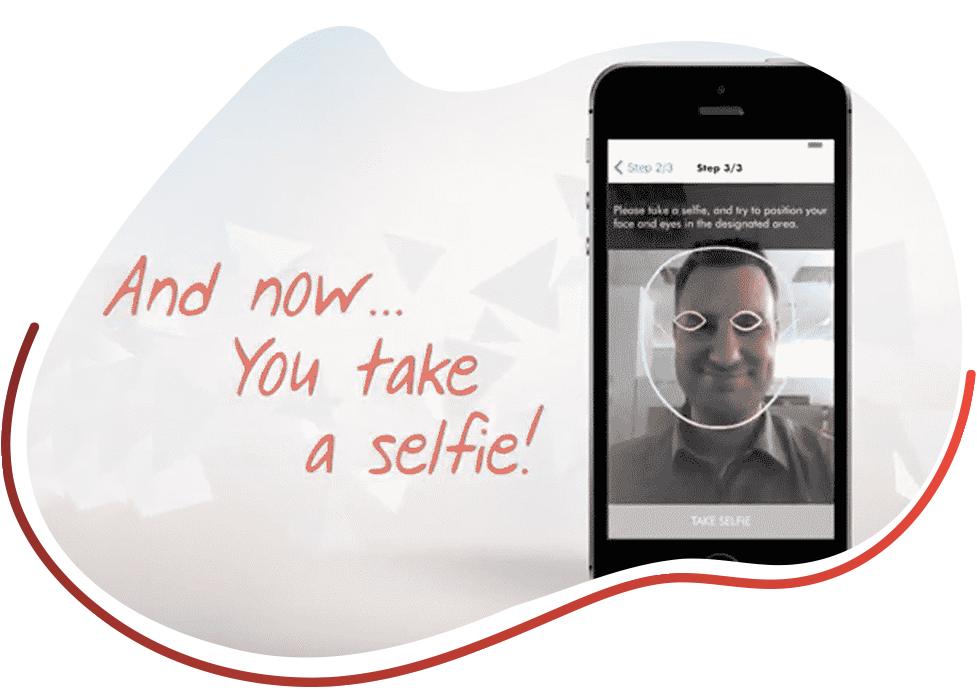

To go through the automated face matching, customers need to scan their ID from both sides and take a selfie to confirm their identity and liveness. After finishing these steps, the system matches the face from the scanned ID and the selfie. Upon success, the KYC is complete and they can continue with the onboarding process. This solution is convenient since it does not require visiting a branch, it can be done fast, and users do not have to worry about their data security.

Personal Finance Management

Helping users to control their finances

With the Personal Finance Management (PFM) feature, users get a complete overview of their expenses and incomes. PFM module allows customers to categorize all their expenditures and revenues from their accounts and credit or debit cards, based on the transactions’ descriptions or the merchant categories. The categorization of the transactions can be done automatically, using the default system rules applicable to all customers or using each customer’s personal rules and manually, by changing the category.

The customers have an option to set their goals (trip to the Maldives, for example) and the bank can easily identify their digital behavior to give them the best loan offers for their dream holiday. They can also create monthly budgets for each category to better plan and manage their expenses. This module contains a financial calendar that allows the customers to set (recurring) reminders for all their expenses and incomes. With PFM, they have full control over their cash flow and can plan their activities on the go.

Optichannel

Engaging customers through various touchpoints

Open Banking/APIs

Improving consumers digital experience

- Optichannel is an omnichannel with additional logic to guide the users to the most optimal channel for each situation, process, or location. This solution will ensure that most procedures will be already performed before customers come to the branch appointment. That’s why by implementing optichannel in your strategy, your customers will get an improved overall experience, accessible products fulfilling immediate needs, and cash flow optimization in combination with personal finance management.

- Banks can optimize content per customer and channel based on user’s habits, geolocation, etc, to give them a more personalized experience. By optimizing, you can expect easier cross-selling of products and increased customer value. Users will be more loyal thanks to excellent customer experience, and the bank will optimize its costs of customer servicing because of balancing digital and physical channel engagement.

- This solution allows banks to connect with external partners that can complement the banking offering through the Open Banking hub. The idea of open banking aims to improve consumers’ digital experience and allow them to access a wide range of products through a single interface and platform. With the help of open banking, they can buy a plane ticket or go to a concert of their favorite band – the possibilities are endless.

- Since most users expect to experience the best services in their bank’s app, financial institutions and software companies need to partner up and give them exactly that – a world of possibilities and many valuable services. That’s why our Open banking partner program is a significant chance to drive innovation and reshape the banking industry’s consumer digital experience.

Augmented Reality

Possibilities beyond borders

- Augmented Reality (AR) solutions can make your bank stand out from the crowd. With AR, your customers can get instant loan offers when looking at a product in your retail partner locations, visualize their expenses, or find an ATM in 3D. But the opportunities don’t end there.

- Did you know that bank users can send money to their friends by using AR? Yes, this is possible, with automatic peer-to-peer recognition of payer and payee credit cards! Besides AR, you can also implement voice assistants in your banking app. With their help, customers can check their balance, pay bills, transfer money, send requests to receive money, make internal transfers, and currency exchange. These features give banks a significant advantage over competitors and bring them more satisfied customers.

Customizability

We support your goals

- FINTENSE, Omnichannel digital banking platform solution has been built with full customizability in mind – existing functionalities can be extensively customized both by the vendor and by the Bank, using FINTENSE SDK

- In contrast to standard native mobile apps which require users to download updates after any modifications, no matter how small, FINTENSE native apps support extensive customization and (re)organization without the need for submitting updates to app stores

- The Bank can change both the design and the user experience using visual tools, and such changes can be live and accessible to app users immediately, without waiting for the app update to be accepted and published.